Do US Biosimilar Markets Function Effectively?

In today’s post, we will explore emerging evidence on the impact of biosimilars on US biologic drug spend.

Overview

Debate on the effectiveness of biosimilars in reducing biologic drug spend has been robust. Critics of the program cite the use of patent extension strategies by manufacturers and a lack of biosimilar uptake in the US as evidence the market is not functioning effectively and that biologic products represent a “monopoly” product. Other observers note the number of approved and commercially launched biosimilars have grown over time and that gross prices for these new products are below that of originator reference brands.

How Can Biosimilars Impact Drug Spend?

Biosimilars can reduce drug spend in two ways:

The launch of lower-priced biosimilar leads to a market share shift from the reference brand resulting in greater utilization of lower cost biosimilars

The launch of a lower-priced biosimilar induces the reference brand manufacturer to lower its net price to compete with biosimilars and slow the rate of market share erosion

Manufacturers electing to take the second option may offer price concessions (rebates or discounts) to payers which result in the reference brand being net priced at proximity to or potentially lower than the biosimilar. The resulting lower net price from the reference brand results in a decrease in drug spend in the therapeutic class even if the biosimilar has limited uptake. Examples of this dynamic in practice are seen in the cases of Remicade and Neulasta in Table 1 below:

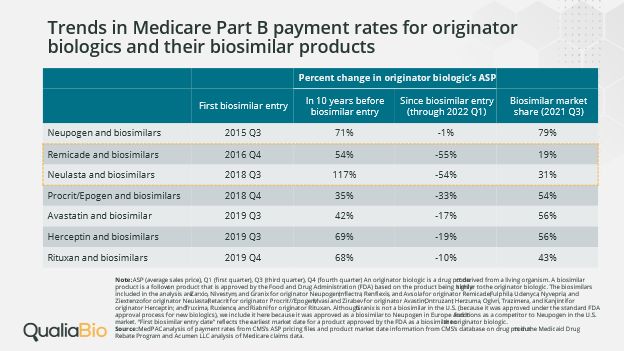

Table 1. Trends in Medicare Part B Payment Rates for Reference Brand Biologics & their Biosimilars

Table 1 uses average sales price (ASP) as a metric to measure price change for reference brand biologics. While ASP is primarily a reimbursement methodology for most drugs covered under Medicare Part B, it also reflects a volume-weighted average selling price by brand which includes most rebates, volume discounts, and other price concessions made by the manufacturer. ASP provides a window into which we can view net price competition between reference brand and biosimilar biologics.

In the case of Remicade, the reference brand experienced a 55% decrease in ASP in the time period between biosimilar entry and 1Q22. This contrasts sharply with the 54% increase in Remicade ASP in the 10 years prior to biosimilar market entry. A similar situation is seen with Neulasta where the manufacturer elected to compete on price with biosimilars as ASP decreased 54% in the time period between biosimilar entry and 1Q22, a significant change from the 117% increase in ASP in the 10 years prior to biosimilar entry. In both of the cited examples, biosimilar market share uptake is low relative to other therapeutic classes – yet drug spend is reduced across the reference brands. Reference brand price concessions are magnified as they are spread across brands which typically have the highest market share in the therapeutic class. The resulting effect is to lower therapeutic class drug spend even in cases where biosimilar uptake is blunted due to a combination of a decrease in reference brand net cost and the uptake of biosimilars.

In some cases, the net price of the reference brand is actually below that of the biosimilar option (data not shown in Table 1). In 1Q22, Medicare’s ASP payment rate for both Remicade and Neulasta was lower than the biosimilar ASP. In 3Q22, one biosimilar to Remicade and one biosimilar to Neulasta had lower ASP payment rates compared to the reference brands while other biosimilars continue to exceed the reference brand ASP.

Thus, looking exclusively at biosimilar market share adoption does not provide a comprehensive view as to how biosimilars may impact drug spend. In addition, the biosimilar may have an indirect spillover effect on reference brand competitor pricing in the same therapeutic class which Qualia Bio will explore in a future blog post.

Impact on the Patient

While reference brand biologic drug costs will be lowered from the payer perspective, patients may not benefit from reduced out-of-pocket (OOP) costs. For patients whose benefit design features coinsurance, the OOP is generally calculated based on drug ingredient cost which reflects the contracted reimbursement rate between a payer and the pharmacy. Unfortunately, payers do not pass on the rebates and discounts they receive for reference brand biologics as part of the ingredient cost. Thus, the patient pays an artificially higher coinsurance rate on the reference brand which is based on a gross price which does not include manufacturer price concessions.

Future Biosimilar Market Dynamics

Several components of the recently passed Inflation Reduction Act (IRA) are expected to impact the biosimilar market once the legislated changes are implemented. The following components of the IRA are intended to boost the adoption of biosimilars:

The “Special Rule” which will delay the selection of reference brand biologics for Medicare price negotiation if there is a high likelihood of an upcoming biosimilar competitor within 2 years

A temporary increase in biosimilar ASP reimbursement rate from ASP + 6% to ASP + 8% in Medicare

Manufacturer efforts to thwart biosimilar competition by means of patent protection may be weakened by the adoption of the IRA "special rule.” An increase in ASP reimbursement for biosimilars may generate increased demand from providers and health systems. Together, these two changes may serve to create an environment which fosters additional biosimilar development and adoption.

An unintended consequence of the IRA legislation could occur due to the implementation of Medicare price negotiations for select high-volume reference brands. In the event the “special rule” is not implemented for any reason, significant decreases in reference brand prices could occur in the latter stages of the brand lifecycle for certain brands – just at the time when biosimilar manufacturers may be considering whether they should move forward with development of a biosimilar version of the reference brand. A decrease in reference brand market revenue could create a disincentive for manufacturers to invest in biosimilar development. Consequently, IRA legislation may create a perverse incentive which results in a lower number of biosimilar entrants to compete with high-spend reference brand biologics.

Closing Thoughts

Qualia Bio’s take is that US biosimilar markets are functioning effectively to decrease biologic drug spend. The market is responding to price signals which may take the form of low net price reference brands or the introduction of biosimilars which provide additional low-price options. The result is that both reference brands which have taken net price reductions and biosimilars have contributed in part to what MedPac estimates as a 15% reduction in Medicare Part B spend between 2019 and 2020 for those categories of biologics which have biosimilar availability.

Questions remain on how the low net price payers receive from some reference brand biologics might be passed on to patients at the point of sale. An additional dynamic to monitor will be the potential muting effect of IRA Medicare price negotiation on biosimilar expansion in the event the “special rule” does not provide biosimilar developers with the confidence they need to invest in future market opportunities.

Contact us with questions or inquiries on additional information. We can be reached at [email protected]