Proposed Prescription Drug Price Reform Legislation

Senate Democrats have submitted proposed new drug pricing reform legislation which, if passed, will have broad implications for the biopharmaceutical industry.

Senate Democrats have submitted proposed new drug pricing reform legislation which, if passed, will have broad implications for the biopharmaceutical industry. Under the banner of “Prescription Drug Reform”, the proposed legislation includes five separate categories which are as follows:

Part 1: Lowering Prices through Drug Price Negotiation

Part 2: Prescription Drug Inflation Rebates

Part 3: Part D Improvements & Maximum OOP Cap for Medicare Beneficiaries

Part 4: Repeal of the Prescription Drug Rebate Rule

Part 5: Miscellaneous

This summary of the proposed legislation provides a high-level overview of proposed changes Qualia Bio believes will have the most significant impact on the Medicare market. Additional details not included in this summary are available and you can contact Qualia Bio for further information as outlined in the “Contact” section at the end of this report.

This post is organized by section consistent with the five categories outlined above. A brief summary of implications from a biopharmaceutical manufacturer perspective is included at the end of the article.

Part 1: Lowering Prices through Drug Price Negotiation

Part 1 of the proposed legislation is focused on lowering prices through Medicare drug price negotiation. Identification of “negotiation-eligible drugs” will occur through a review of the top 50 Medicare Part D and Part B drugs based on total expenditures for each drug. From this initial list, the top 10 single-source brand name drugs by total expenditures would be targeted for government negotiations on a “maximum fair price” beginning in 2026. This initial list would expand to 15 drugs in 2027 – 2028, and 20 drugs in 2029.

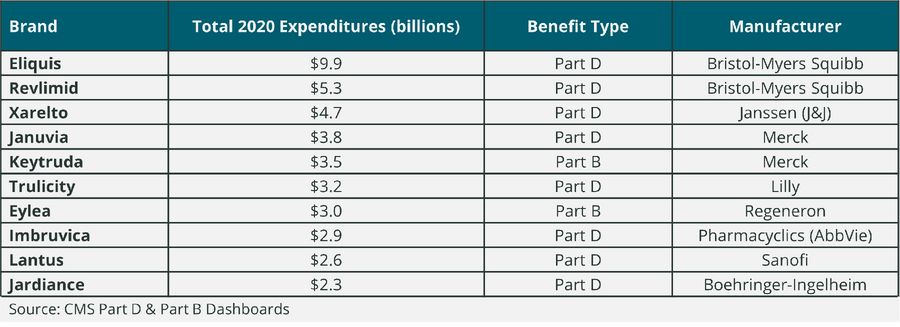

To provide an illustrative example as to which types of drugs might qualify for being “negotiation-eligible” in the initial year of the program, Qualia Bio reviewed the top 10 drugs in Part D and B by total expenditures in 2020 (see Table 1). While this list does not reflect the Medicare calendar year data that will be evaluated to identify negotiation-eligible drugs for 2026, it does provide a sense of the volume and related total expenditures by drug which could make a brand a potential candidate for Medicare drug price negotiation.

Table 1. Top 10 Part D and Part B Drugs by Total Medicare Expenditures in 2020

Part 2: Prescription Drug Inflation Rebates

This section of the legislation provides a description of rebates to be provided by manufacturers of single source (e.g., brand) Medicare Part B and Part D drugs with prices increasing faster than inflation. Part B and D rebatable drugs are defined as single source drugs or biologicals with price changes exceeding an inflation benchmark.

The specific CPI used as a benchmark to Part B and D drug price changes is the CPI-U for all urban consumers (US city average) for a previous 12-month period. Branded Part B or D drugs which have price increases exceeding the threshold amount would be subject to drug inflation rebate payments. Manufacturers will be required to provide the specified rebate within 30 days of receipt of the rebatable drug report from the government.

Language is included which serves to exclude Part B and D drug inflation rebates from best price and average manufacturer price, or AMP calculations.

If this legislation is passed, the government initially plans to begin reporting on Part B rebatable drugs in January 2023 and Part D rebatable drugs in October 2022.

Part 3: Part D Improvements & Maximum OOP Cap for Medicare Beneficiaries

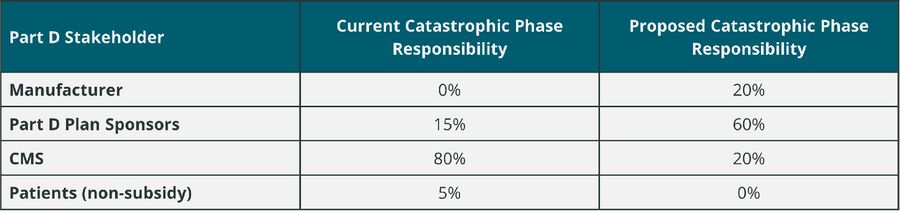

As part of changes in the Part D benefit design, the proposed legislation would change the relative contribution of various Part D stakeholders for what is called the “reinsurance” phase of the benefit design. Reinsurance is more commonly known as the catastrophic phase of the existing Part D benefit design. In the redesign of the Part D benefit, stakeholder responsibility for drug spend in the catastrophic phase would change as follows:

Changes are also planned for the existing Medicare Coverage Gap Discount Program (CGDP). New legislation proposes that the CGDP sunsets as of 1/1/25. It appears that the proposed changes to manufacturer responsibility for brand drug spend in the catastrophic phase of the Part D benefit will be the replacement for current CGDP fees paid by manufacturers.

A manufacturer discount program is included as part of the proposed legislation. While it is not entirely clear as to the full extent of the program, it appears the program would extend manufacturer drug discounts (discounts are paid proactively, rebates are paid retroactively) to the pharmacy or mail order provider which dispensed the drug in question. Details as to how this might be accomplished are not available, but it does appear that the intent to share manufacturer discounts with patients at the point-of-sale is part of the legislation.

New legislation proposes that out-of-pocket (OOP) drug costs would be capped at $2,000 annually for Medicare beneficiaries. Premium stabilization is also included as part of the proposed change to Part D. Annual premium growth would be capped at 6% from 2025 through 2029.

Part 4: Repeal of the Prescription Drug Rebate Rule

Part 4 prohibits implementation of the rule relating to eliminating the anti-kickback statue safe harbor protection for prescription drug rebates. This is a rule from the Trump administration which sought to direct prescription drug rebates directly to consumers and subsequently lower their OOP costs.

Part 5: Miscellaneous

A qualifying biosimilar product may receive a temporary increase in Medicare Part B payments. For an applicable 5-year period, reimbursement shall be 8% instead of 6%. The applicable 5-year period is defined as beginning on 10/1/22 and ending on 12/31/27. A qualifying biosimilar is defined as one in which the ASP for a calendar quarter in the 5-year period is not more than the ASP for the same quarter for the biosimilar reference brand.

Implications

For biopharmaceutical manufacturers of Part B and D brand drugs, the direct risk of Medicare price negotiation is largely limited to a small number of manufacturers. However, this list will grow over time, and there is an indirect net price risk for manufacturers who have drugs which may compete in the same therapeutic class as a negotiation eligible drug.

All manufacturers of Part B and D drugs will be impacted by prescription drug inflation rebate rules. This legislation would extend the reach of price protection from the commercial and Medicaid segments to Medicare. In addition, the use of CPI-U as the price increase threshold may offer some initial benefits given recent inflation trends, but could be a limiting factor over time as consumer inflation factor has generally trailed medical inflation rates in the past.

The proposed changes to the Part D benefit design pose a significant risk for Part D drug manufacturers. Plan sponsor’s increased exposure to drug cost in the catastrophic phase could result in payers requesting higher rebate rates or narrowing the number of brand options available on their formulary. In addition, manufacturers will have to reassess how their current coverage gap liabilities will change with the sunset of the CGDP and rise of catastrophic phase liability.

Contact Information

Contact us to schedule a complimentary 30-minute webcast for you and your team in which we review the key components of the proposed legislation and identify the associated market access risk factors. We can be reached at [email protected]